Batman had Robin, Fred Astaire had Ginger Rogers, John Lennon had Paul McCartney, Steve Jobs had Steve Wozniak (but both needed the design brilliance of Jonny Ive) and Warren Buffett had Charlie Munger.

Sure, there are mavericks who appear to be quite capable of succeeding on their own. The likes of Elon Musk, Jeff Bezos, Larry Ellison and Richard Branson are without doubt visionaries and appear to have achieved great success without an obvious co-pilot. But even they have not done it alone. They tend to appoint experts in their respective fields to deliver on their vision and that is okay too, but it cannot be nearly as rich a life experience as having someone you respect deeply challenge and support you as you build.

Having a foil in business, as in life, is critical for balance and can help in making better decisions. Had Elon Musk had a Charlie Munger by his side, would he have bought Twitter for example? Probably not – if he’d had the right partner by his side.

It’s not as if they didn’t make mistakes and were not guilty of group-think – but on balance they did better together and certainly seemed to have a better time as the Carol Loomis biography of Warren Buffett put it: “Tap dancing to work.”

What are key lessons we can learn from the pair who took at dilapidated textile mill called Berkshire Hathaway and converted it into one of the most successful investment companies in the world?

Great relationships endure good times and bad

They teamed up in 1959 and ran Berkshire Hathaway through thick and thin. They would no doubt have had times when they disagreed and even considered splitting up. When I asked how three founders of a large investment bank how they had managed to maintain not just their business relationship over four decades of building a massive enterprise from scratch, but their mutual respect and friendship; one of them responded: “I once asked my wife if she’d ever considered divorcing me. She replied: “Divorce? Never. Murder. Often.” Good business relationships stand the test of time, but not without some disagreement.

Mutual respect

You cannot have an enduring relationship of any kind if there is not mutual respect. Buffett and Munger brought complementary skills to their long-standing business arrangement. Buffett, heavily influenced by the lessons of investing guru Benjamin Graham was able to identify undervalued companies, while Munger had the ability to look through crises through what biographers referred to as his “multi-disciplinary” thinking. They had common beliefs, primarily that the future will mostly be better and more prosperous than the present, and that you should never bet against the ingenuity of the American economic system to self-correct even after a deep crisis.

Shared Investment Philosophy

They might have had different ways of dissecting investing but shared the same long-term, value-investing philosophy. Any partnership that is not built on shared values is doomed to failure.

Open Communication

I have never learned as much while laughing quite as hard as watching the Buffett/Munger stage performance in Omaha. Buffett did most of the talking, but the big lessons came in the form of witty anecdotes and wisecracks from Munger.

They sat on the stage for six hours broken into two- three-hour sessions simply talking about how they understood the world and why they were making the decisions they were taking. And their investors loved every moment.

Munger would make quips like: “The big money is not in the buying and selling, but in the waiting,” and a personal favourite: “Go to bed smarter than when you woke up.”

Homespun wisdom from a powerful thinker.

Honesty

They admitted their mistakes and explained them to shareholders, not in a fawning apologetic way, but coolly and factually. It was their ability to understand where and why decisions they had taken had not worked, to own up to them and strive to do better next time, that endeared them to their investors. In sharp contrast if you take time to read through earnings reports of underperforming companies at the moment, you will find management teams using high inflation and interest rates as a shield against their inability to navigate the complexity of the world. Fair enough, it’s tough, but managers are paid the big bucks in bad times to figure this stuff out. They didn’t duck and dive their fiduciary responsibility to their clients.

Collaboration

While Buffett would make the final call on investments, it was not done without Munger’s input. Investors appear better served over the long term by collaborators than mavericks who do not respect the views of others.

Sense of Humour

You will spend more of your waking life with your colleagues than anyone else. Make it a rule that you only partner with those with whom you share a sense of humour.

Humour is one of life’s most underrated qualities.

It can break tension, be used to make a critical point, and is probably the best teaching tool available. You would never give your investment money to Mr. Bean, but you might very well invest in Rowan Atkinson’s next comedic venture. Nobody gives money to a fool, but certainly if humour is a sign of intelligence, then finding someone who can tickle your funny bone makes the drudgery of admin and compliance tolerable.

The ability to spark off your colleagues and particular your business partner is one of the most enduring lessons of the Buffett/Munger partnership which was evident in their public appearances, annual meetings, and interviews. Their lighthearted banter and wit made them human and relatable even as their enormous brains were doing computations that would be impossible for the rest of us to contemplate.

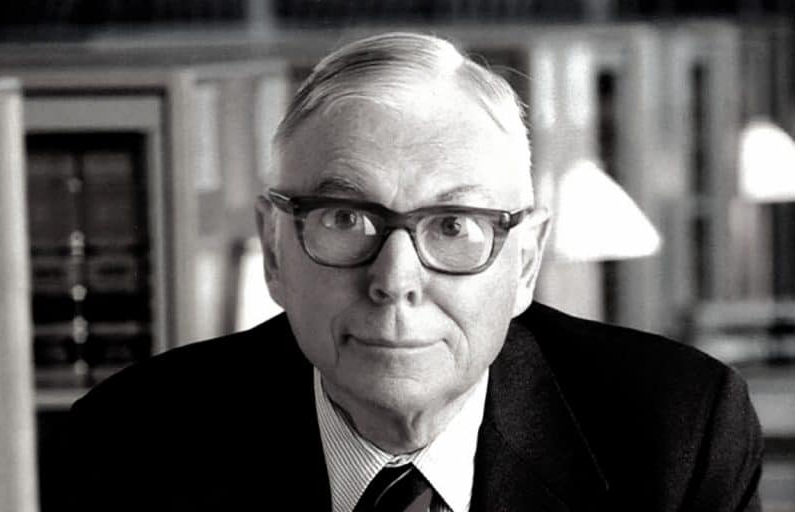

Farwell Charlie Munger. Thank you for your wisdom.